Working for yourself is appealing — you set your hours and avoid the pains of micromanagement. The increase in virtual businesses makes freelancing more accessible than ever.

Since more and more Americans work remotely, companies can hire freelancers who work from home from across the globe. This accessibility means freelance businesses are more valuable — and successful — than ever.

According to Upwork’s 2022 Freelance Forward survey, the U.S. houses 60 million freelancers contributing over $1.35 trillion to the economy. Freelancing is at an all-time high — and freelancers are loving it. Upwork found that 68% of freelancers say they’re happier working for themselves than they were working a traditional job. Now’s the perfect time to join them.

What does it mean to be a freelancer?

Being a freelancer means you provide products and services to others but ultimately work for yourself. You set your own rates, start and stop working with clients whenever you want, and work on multiple projects at a time (unless you’ve signed a contract that says otherwise).

Clients of all types — individuals, large corporations, startups — employ freelancers. You’ll work full or part time depending on what you choose to take on; work through contracts, by project, or hourly; and file your taxes as a self-employed worker.

This flexibility is attractive. But starting a freelance business has some drawbacks. Unless otherwise stated in your contract with a company, you won’t receive any benefits like paid time off or health insurance. You might also lose some financial stability if your income depends on ebbing and flowing projects.

Still, a successful freelance business can enjoy income stability with returning clients and use their revenue to pay for any necessary benefits. And, if you want a slower month, you can turn down a contract or two to lighten your workload or pick up extra work to increase your cash flow.

Freelance business ideas

A freelance business is anything you do independently to make money (so the neighborhood kid selling lemonade is technically a freelancer). But some positions are more manageable than others — and more scalable. Here are a few excellent choices for freelance work:

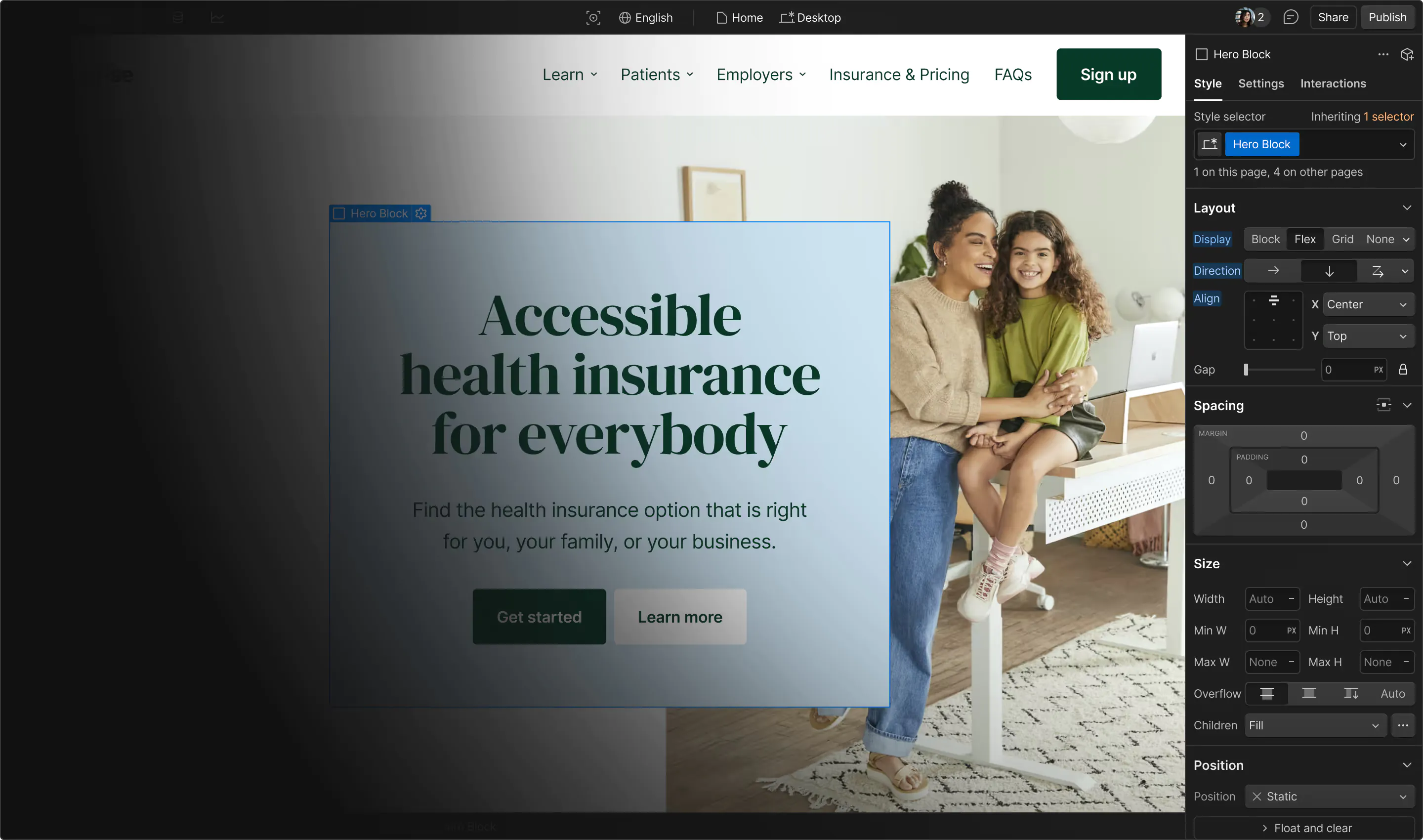

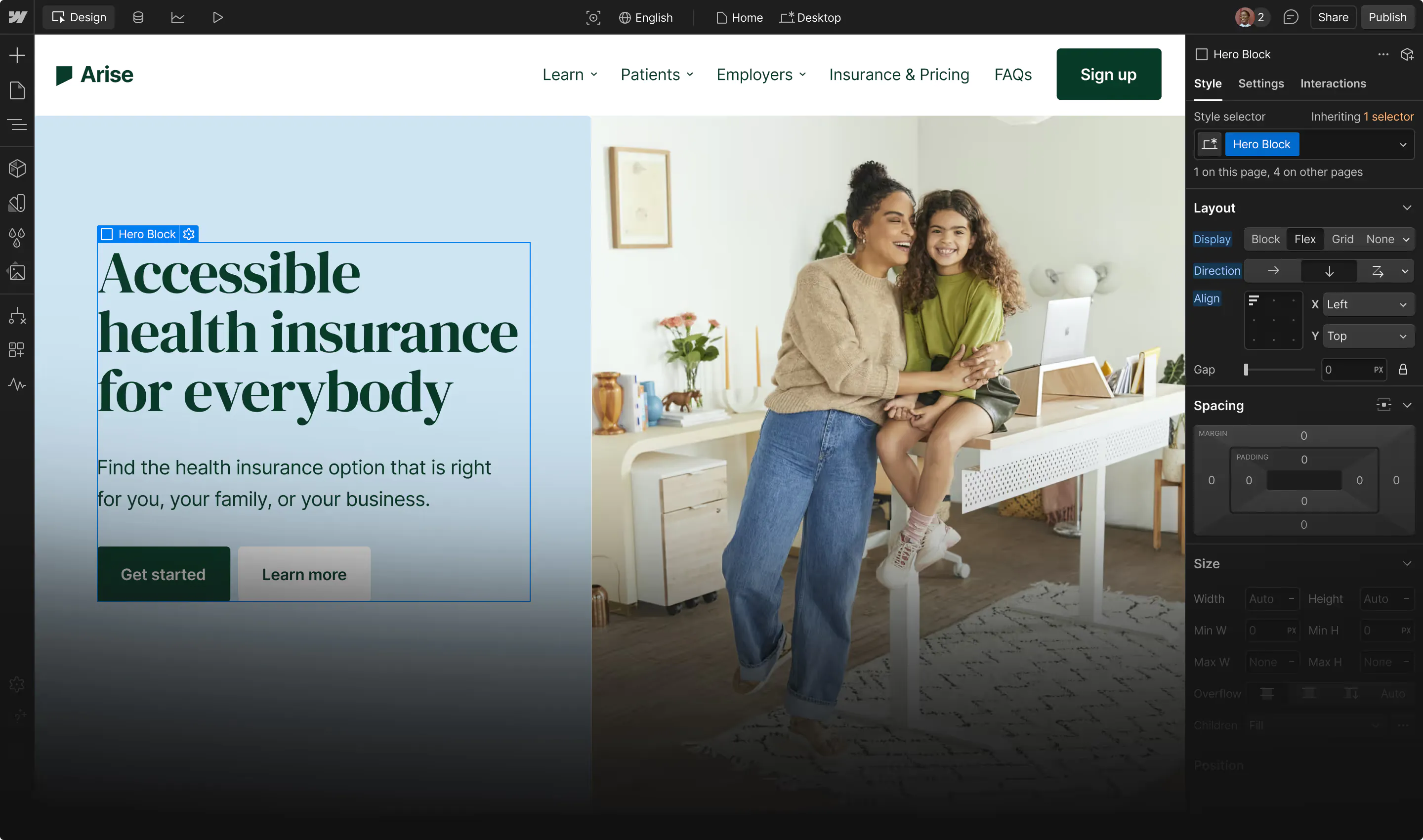

- Web designer: These professionals use coding or no-code development platforms to design websites. You need an eye for color and composition, design chops, adaptation skills to accommodate varying client requests, and knowledge of basic search engine optimization (SEO) practices to create competitive, engaging sites.

- Photographer: If you’re handy with a camera, you could start a photography business freelancing for several clients or selling your images to stock photo sites like Getty Images or Shutterstock.

- Video editor: Video is one of the most effective and popular forms of marketing, so video editors are always in demand. You only need a powerful graphics card, some basic editing knowledge, and an eye for storytelling and flow.

- Graphic designer: These professionals typically use programs like Photoshop and Adobe Illustrator to create graphics for various projects, like logos and background images or billboards and physical mail-in ads.

- Copywriter: Copywriters create the text for virtual and physical promotional material, like SEO-focused articles, UX content, social media posts, and email campaigns.

- Data analyst: These freelancers organize and analyze data for clients in every industry. The data analyzed could be anything — click-throughs on a website, finances, or quarterly key performance indicators set out by the company.

- SEO consultant: Optimizing content to rank higher in Google’s search engine results pages (SERPs) is complex work requiring a smart strategy and frequent improvements, and not all marketing teams have SEO experts on hand.

- Artist: For a more hands-on approach, you could sell your crafts — paintings, jewelry, wooden kids’ toys — through online markets like Etsy, Amazon Handmade, and Society6 or at farmers markets or fairs.

21-day portfolio

Design and build a custom portfolio website, visually, within 21 days.

How to start a freelance business: 8 steps

If you’re ready to begin your freelance career, start strong by following these eight steps:

1. Define your area of expertise

It’s time to pick an idea. Ask yourself: What product or service do I want to offer? This might mean picking up new skills or completing formal training before you’re ready to meet your clients’ needs.

2. Determine what you want from your business

Consider your values and what you hope to gain from your freelance business. You might want a part-time hustle that supplements your current job, or maybe you’d love to start a six-figure design agency after gaining some experience. Freelancers can also sign full-time contracts with larger organizations that offer stability but tie them down to strict working schedules. If you want more flexibility, you might prioritize being paid hourly and taking on multiple, smaller-scale contracts.

3. Define your target audience

You can learn more about what clients want and what you have to offer by filling out portfolios on freelance finder websites like Upwork and Fiverr. You don’t have to take any work from the sites, but looking at wanted ads and creating profiles helps you understand what potential clients need.

4. Set realistic and measurable goals

Don’t expect to get rich overnight — from upskilling to marketing, becoming a successful freelancer takes a lot of work. Make the workload manageable by creating SMART goals: specific, measurable, achievable, realistic, and time-bound. You’ll break down larger tasks like “market my business” into more digestible items like “create an Instagram account” or “draft a week’s worth of Facebook posts” so the entire process feels less overwhelming.

5. Determine your prices

The marketplace for freelancers constantly fluctuates, and freelancer rates vary depending on their experience and the quality of work. While setting your own wages can be daunting, you can use online tools or research other freelancers in your area with the same offering to help determine your prices.

6. Build a fantastic web portfolio

A great way to show off your skills is with a portfolio website that you link to on social platforms and share with potential clients through email or ad marketing campaigns. This landing page is a hub showcasing your talent so visitors understand what you do and why you’re great at it.

7. Market your services

Once your portfolio website is live and you’ve set up your social profiles, it’s time to market your services. Network with your personal and professional community to spread the word about your offering, and regularly add content to your blog and social accounts to build brand awareness and increase visibility.

8. Strategically choose your first client

To build your skills and portfolio, consider working on simulated projects (build a website for a pretend beauty brand, for example) or providing your services to friends and family for free. This way, you can get your bearings and gain experience before working for clients like large organizations with complicated projects.

Tips to improve your freelance business

One of the most challenging parts of freelancing is gaining visibility to grow your business. Securing new clients can be just as time-consuming as doing the actual work. Here are some tips to help you share your fantastic product or service:

- Make your portfolio stand out: Because freelance businesses are booming, potential clients have many options. Make your portfolio stand out by using unique and engaging templates.

- Network, network, network: Part of growing a freelance business is constant self-marketing — and that means telling people about your business. Go to events, bring up your services at dinner parties, and post online often to draw new customers to your site.

- Keep learning: Just as you’re responsible for your business’s visibility, you’re responsible for your professional development. You’ll only be able to raise prices or gain higher-paying clients if you can deliver better work than when you started. Keep up with industry trends, take courses to improve your skills, and develop a growth mindset to scale your business.

- Consider being an LLC: Registering as a limited liability company (LLC) makes paying taxes more straightforward and protects you from some liability risks.

Start your freelance career with a great website

Potential clients head to your website to learn more about your offering and find your contact information. Make it stand out and increase conversions by building it in Webflow, a visual web development platform that offers templates, analytics, and customer relationship management (CRM) features. Get started today.

Build websites that get results.

Build visually, publish instantly, and scale safely and quickly — without writing a line of code. All with Webflow's website experience platform.