As a freelancer, there’s no greater joy than sending your client an invoice — except perhaps receiving payment

Whether you’re a freelance writer, photographer, or web designer — you’ve earned compensation. Most freelancers are paid through invoices, which generally contain an itemized list of the services provided, the company they were provided for, and the cost.

However, invoices represent more than just documents demanding payment.

Freelance projects aren’t the same each month — services and prices change, making it challenging to keep track of all the numbers. Invoices are essential for freelancers to manage their finances and stay organized. When tax season comes, organized invoices also help freelancers know how much they’ve earned and what they owe.

You don’t necessarily need an accountant to manage your finances. Many resources help create invoices and streamline workflows in the form of invoicing software.

If you’re not sure if invoicing software is right for you, we’ll explain the importance of accurate invoicing for freelancers and how to take advantage of the internet’s best online invoicing tools.

Why you should consider an invoice software

Creating templates to track your invoices in traditional programs like Word and Excel is reliable, but you need to enter data manually. This consumes time that you’re better off spending working (and billing clients).

With freelance invoicing software, easy-to-use tools connect directly to your bank account for streamlined payment. Invoicing software files records of your contracts and payments in one centralized place.

Invoice software also has benefits like automated invoices and tax calculations. Many software programs offer freelance invoice templates which save you time by automatically filling in standard information like your address, company name, payment timeline, etc. Often, invoice software will generate tax reports automatically as well, helping you stay current on tax payments thorughout the year.

Invoicing software lets you focus on other aspects of your freelancing business without the hassle of last-minute emails or incorrect invoices. Instead, the software tracks all your clients and payments in one place.

How to choose the best invoice tool

A "one-size-fits-all" approach won't work for invoicing software. As a freelancer, it's important to analyze various factors that will help you choose the best one for you, including:

- Number of clients. Having a large clientele may require more advanced invoicing software that can handle multiple accounts simultaneously.

- Total recurring invoices. Freelance projects differ by nature — some may work on a retainer basis, while others are one-time projects. If you tend to take on long-term projects on a retainer model, it’s best to choose invoicing software that automates billing at regular intervals to avoid missing a payment.

- Payment methods. Do you provide international services? What are the exchange rates in the countries you work with? Is PayPal your preferred payment method of payment? Choose a tool that supports your preferred payment method along with other options to make the process easier for you and your client.

- Your niche. Take your niche and industry into account. If you’re a designer, look for tools that allow you to modify or add elements to create attractive, design-focused invoice templates. Clients appreciate an aesthetic touch, even in the smallest details.

Depending on your needs, some of these factors affect the software’s cost. For example, you may prefer software that lets you send personalized emails to all clients. That might not be a standard feature offer, so analyze your specific use case before choosing.

The 6 best invoicing tools and apps for freelancing

Hundreds of invoicing tools and apps for freelancers are available online. But which one is the best for you? We’ve compiled a list of the best invoicing tools for freelancers to help you find the one that suits your needs.

1. Square

Square is an invoicing tool that allows clients to pay in-person or remotely via credit card, Apple Pay, Google Pay, or bank transfer. It has three plans:

- Free

- Plus ($29 a month)

- Premium (custom pricing, depending on your needs)

Square lets you filter plans by business type and offers compatible hardware for in-person transactions. You can add various tools like an online store, checkouts, and digital gift cards through your website — many of them for free.

However, keep in mind that there’s no multi-currency support, so you’ll only be able to send invoices to clients that reside in the same country. For example, if you work in the US, you can’t use Square for a client in South Africa, as both countries use different currencies.

We recommend Square for freelancers looking for a simple, no-nonsense invoice with convenient online payment processing.

2. Quickbooks

Quickbooks includes a wealth of features to track income, collect payments, and invoice clients. It's an excellent tool for freelancers providing financial services, although it does have a slightly older interface with limited currency support and automation features.

Quickbooks offers four plans:

- Simple Start ($30 per month)

- Essentials ($55 per month)

- Plus ($85 per month)

- Advanced ($200 per month)

Depending on what you need, Quickbooks offers support in any of these areas and more:

- Accounting

- Inventory

- Payroll

- Tax filing

- Expense management

- Payment processing

We recommend Quickbooks for small businesses and freelancers offering financial services, like accountants or wealth management consultants.

3. Wave

Wave offers extensive features for bookkeeping purposes, including free invoicing and accounting software. It provides unlimited invoicing and expense tracking with customizable templates and syncs all your payments automatically.

You can accept online payments using Wave's proprietary “Wave Payments,” but consider the transaction costs before selecting a plan. The Invoicing, Accounting, and Banking plans are free, but pricing for other plans depends on the state you reside in and cards you use.

When using a credit card for the “Payments” plan, the transaction fee is 2.9% + $0.60 on Visa, MasterCard, and Discover cards, while American Express payments incur a 3.4% surcharge + $0.60 per transaction. For bank transfers, there’s a 1% transaction charge with a $1 minimum fee.

Wave’s free tools are great for freelancers, while paid plans suit most small and medium-sized businesses.

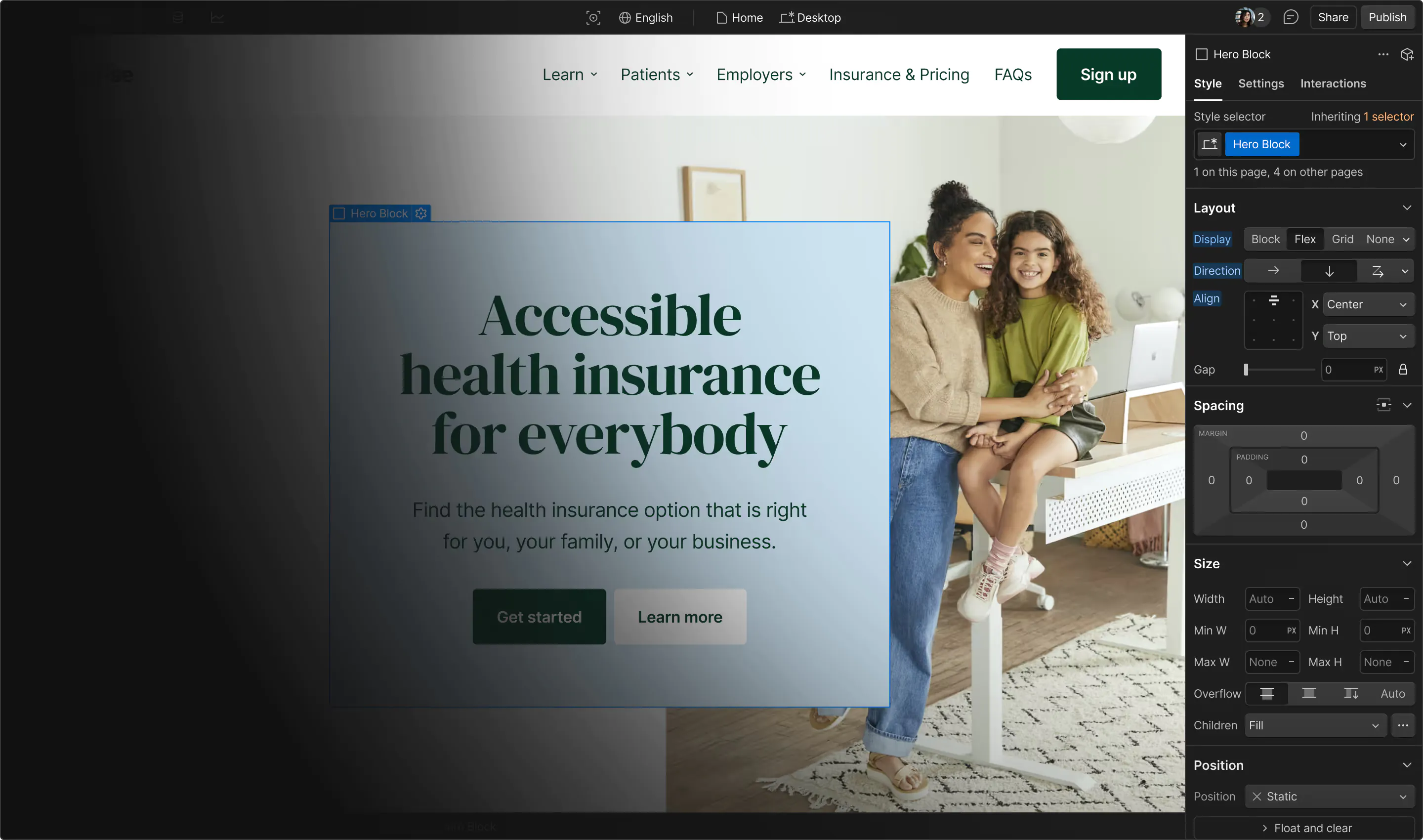

Get started for free

Create custom, scalable websites — without writing code. Start building in Webflow.

4. Bonsai

Bonsai is a customer relationship management (CRM) tool with invoicing features targeted toward web designers and engineers. Despite not having scheduling or instant booking, Bonsai includes top-notch functionality for client management, proposals, automatic payment reminders, and tax calculation.

Invoices are customizable with an array of templates, which is great for designers or creatives looking to give their invoices some flair. Bonsai is integrated with ACH, Stripe, and PayPal. It comes in three plans:

- Starter ($24 per month)

- Professional ($39 per month)

- Business ($79 per month)

Prices differ between monthly and yearly options. If you opt to pay a one-time annual fee, you'll receive two months' worth of Bonsai free.

5. Bloom

Bloom is a go-to invoicing tool for creative professionals. Its feature-rich interface allows you to customize invoices, set retainers, accept tips, and offer zero-interest financing. Bloom is cheaper than other invoicing tools and lets you keep a larger portion of your earnings.

There are two plans:

- Starter (free)

- Premium ($42 per month if you pay monthly, $33 per month if you opt for the annual plan)

Bloom's free plan is powerful enough for most people, and its invoice generator allows you to create and send invoices to clients in minutes.

6. Freshbooks

Freshbooks is one of the costlier options on this list, but it offers comprehensive accounting services for freelancers who want premium finance management features. It has various project management tools, time tracking, bill reminders, multi-currency support, real-time updates, and more.

Freshbooks offers four plans, each with a free trial that you can test without a credit card. They are:

- Lite ($7.50 per month)

- Plus ($15 per month)

- Premium ($27.50 per month)

- Select (custom pricing depending on needs)

The Lite and Plus plans are affordable options for those with 5–50 clients.

Invoice checklist for designers

If you’re on the way to creating a personal brand, you may be new to invoicing and the finances behind it. Creating an invoice for the first time can be tricky, so it’s important to know the dos and don’ts to avoid common invoicing mistakes before sending your first invoice.

Invoices shouldn’t have loud designs, but they should be professional and visually appealing, especially if you're a freelance designer.

Here’s our checklist of things to consider as a freelance designer:

Reflect your brand

Your invoice should reflect your work and personal brand. Ensure your invoice's aesthetic is consistent with the rest of your work. For example, if your personal portfolio uses Roboto font and a blue and yellow color combination, incorporate those visual elements into your invoice alongside your logo.

Make it clear but creative

While you want to make your invoice look attractive, don’t take away from its functionality — the aim is to balance passion with profit. Strike a balance between clarity and creativity when designing each invoice. Stick with legible fonts and high-contrast colors to increase readability and keep graphics to the corners to avoid distracting from the main information.

Focus on the list of services

The list of services provided makes up the majority of the invoice. Be specific about each task you completed to eliminate potential doubts. Create a separate line for each item, with the date, details, and cost. Include the number of hours you worked if you charge hourly rates.

Include invoice numbers and dates

If you cater to multiple clients, keep track of invoice numbers in ascending order for each client and remember dates for recurring payments. For example, if you’ve completed your fourth project for Client A, send them an invoice with the number “INV004” and the date. If you’re starting work for a new Client B on the same day, send them a fresh invoice titled “INV001.” It helps to keep things organized with multiple folders on your device or in your invoicing software.

Add your contact information

Satisfied customers usually rehire or refer freelancers to friends and family looking for similar services. Whatever the reason, including your contact information is a must. Add your name, phone number, and email address. If you run a small business, include your business' registered address and VAT number.

Mention your policies

Include information about your preferred payment methods, late fees, nonpayments, and so on. Consider adding policies that demand a late fee if your client fails to pay by the deadline set in your freelance contract. These policies are pre-agreed clauses that act as insurance to avoid any conflict when pay day arrives.

Boost your skills and charge more

These six invoicing tools are excellent choices for new and experienced freelancers. Many of them are great for managing finances and provide services like tax calculations and online store add-ons.

As a freelancer, the aim is to have a skill set that attracts clients who value and pay for your work. As you find more work and grow in your freelance journey, you’ll make a name for yourself and boost your freelance reputation. The more you develop, the more you can charge.

At Webflow, we have the resources to take your freelancing skills to the next level. Our free courses, tutorials, and guides have step-by-step instructions that make learning easier — and fun.